© 2024 CSRXP- All Rights Reserved

DOSE OF REALITY: BIG PHARMA’S TWO DECADES OF PRICE HIKES AND ADVERTISING BINGING ON TEN DRUGS ELIGIBLE FOR MEDICARE NEGOTIATION

Sep 20, 2023

A History of Big Pharma’s Egregious Pricing Practices and Billions of Dollars in Spending on Direct-to-Consumer Advertising

The U.S. Department of Health and Human Services (HHS) announced the first 10 drugs eligible for negotiation in the Medicare Part D program. The drugs are all prolific earners for the Big Pharma companies that market them. Since their introduction, these companies have spent significant sums pushing high-priced brand name products through direct-to-consumer (DTC) advertising and have leveled significant and repeated price hikes on the treatments without any corresponding increase in clinical value for patients

CSRxP recently examined the available data on DTC advertising spending for these drugs and their history of price increases — which provide just a snapshot of the scale of anti-competitive practices across Big Pharma’s brand name blockbusters.

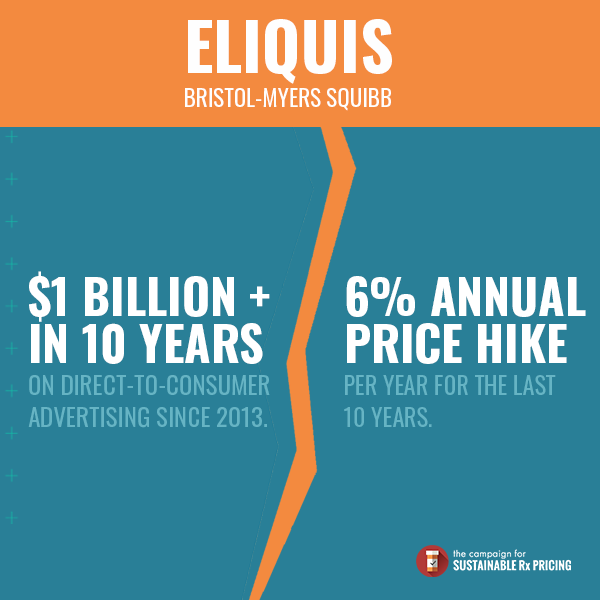

Eliquis – Bristol-Myers Squibb and Pfizer

Big Pharma giants Bristol-Myers Squibb and Pfizer have spent more than $1 billion in direct-to-consumer advertising since 2013 on their blockbuster blood-thinning drug Eliquis while increasing its price by at least six percent per year for ten years. In 2013, when Eliquis entered the market, it carried a monthly price tag of $250 – but last year, the list price for a one-month supply of Eliquis was $529, more than double when it came to market. This has resulted in massive profits for both Big Pharma companies. In 2022, Eliquis brought in $11.78 billion in revenue for Bristol Myers Squibb and $6.48 billion in revenue for Pfizer.

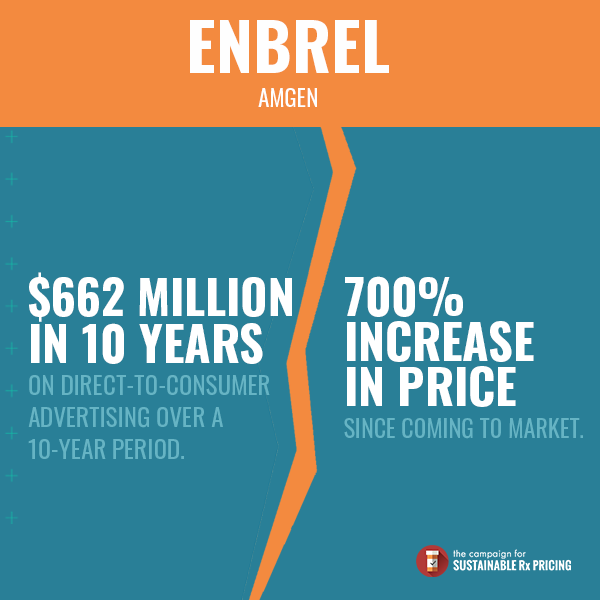

Enbrel – Amgen

Amgen’s rheumatoid arthritis drug Enbrel has increased in price by more than 700 percent since coming to market, according to a recent analysis by AARP’s Public Policy Institute. Over a ten-year period from 2006-2017, Amgen spent a whopping $662 million in direct-to-consumer advertising on the drug. Enbrel may become Amgen’s longest-lasting and highest-earning product, with patents protecting it from competition until 2029 – when cumulative drug sales are expected to top $100 billion. In 2022, Enbrel brought in $4.1 billion in sales for Amgen.

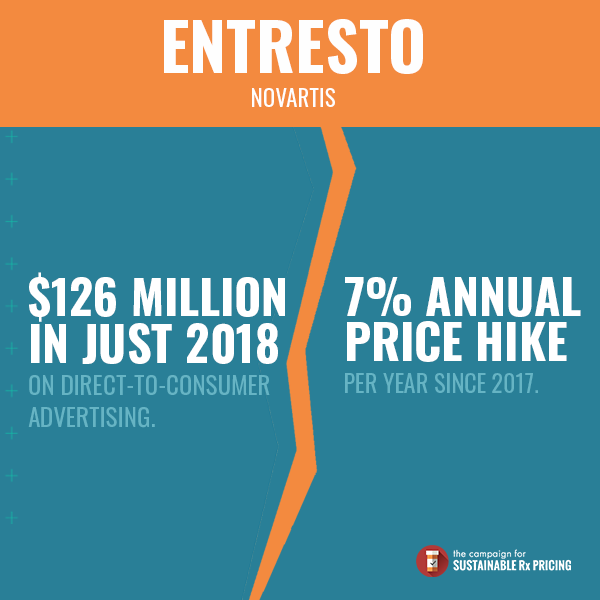

Entresto – Novartis

Novartis’ blockbuster cardiovascular drug Entresto has routinely seen annual price hikes. Since 2017, Entresto’s price has increased more than seven percent every year. In 2018, Novartis spent more than $126 million in direct-to-consumer advertising on the drug, landing Enbrel in the top 15 brand-name drugs advertised to consumers that year. In 2022, Entresto brought in $4.64 Billion in revenue for Novartis.

Farxiga – AstraZeneca

AstraZeneca’s kidney disease and diabetes drug Farxiga has seen annual price hikes of at least three percent each of the last eight years, including 9.9 percent price increases in 2015 and 2017 and a six percent price increase in 2019. The drug yielded $4.38 billion in 2022 revenue for AstraZeneca. Over a decade leading up to 2017, the brand name drug maker spent more than $265 million in direct-to-consumer advertising on Farxiga.

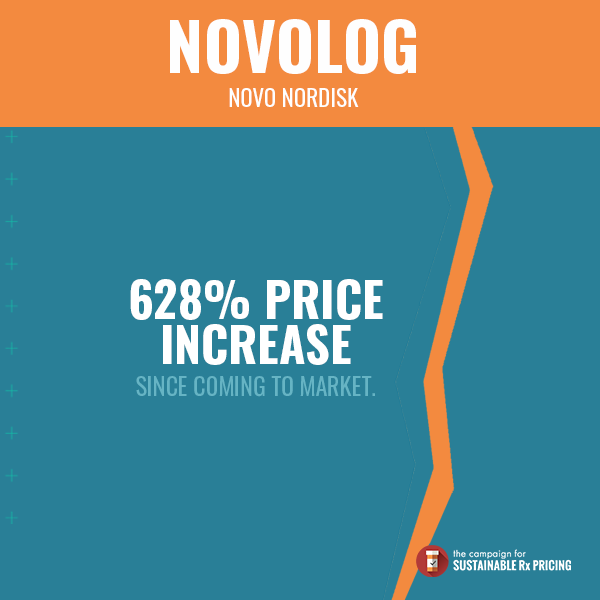

NovoLog – Novo Nordisk

NovoLog, the blockbuster diabetes treatment from Novo Nordisk, has seen relentless price hikes during its time on the market. From 2012 to 2018, Novo Nordisk increased the price of Novolog by at least five percent more than 10 times. Since the drug’s launch, its price has skyrocketed 628 percent. In 2022, NovoLog brought in $2.26 billion in net sales for Novo Nordisk.

.

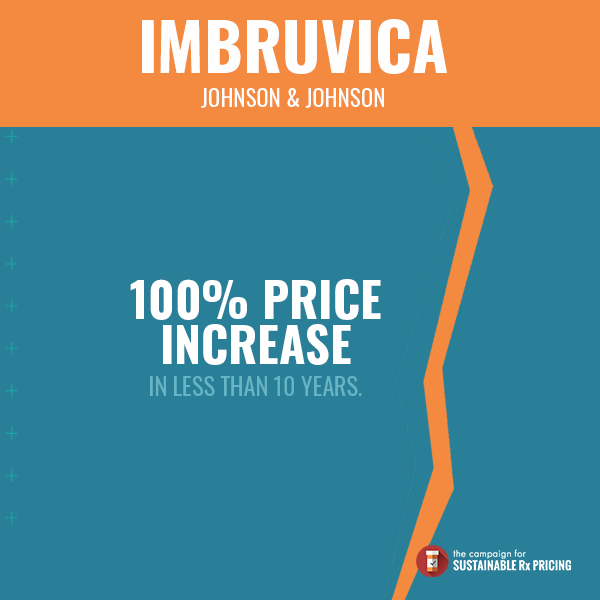

Imbruvica – Johnson & Johnson

Johnson & Johnson and AbbVie have increased the price of Imbruvica by at least six percent every year since it came to market. In total, the price of Imbruvica has increased more than 100 percent in less than ten years. In 2022, Imbruvica brought in $4.568 billion in revenue for AbbVie and $3.784 billion in sales for Johnson & Johnson.

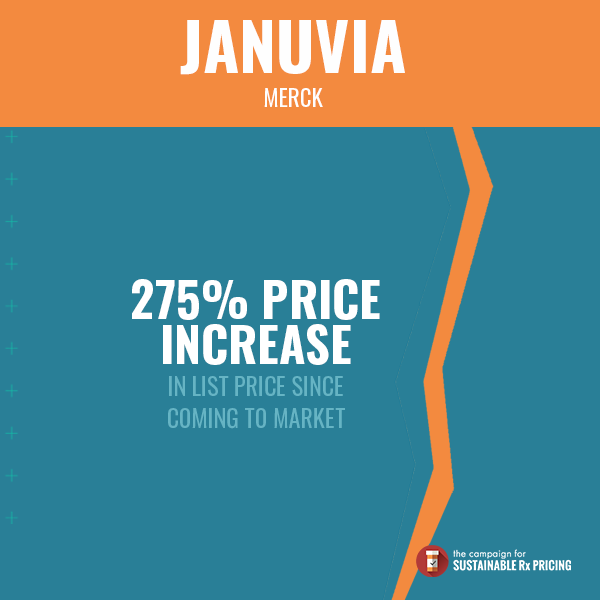

Januvia – Merck

Merck’s longstanding blockbuster Januvia has routinely seen annual price hikes. Since 2017, Januvia’s price has been hiked at least 4.9 percent every year. Dating back to the drug’s approval by the U.S. Food and Drug Administration (FDA) in 2006, the drug list price has increased 275 percent. These price hikes have made Januvia a top earner for Merck – last year, Januvia brought in $2.813 billion in revenue.

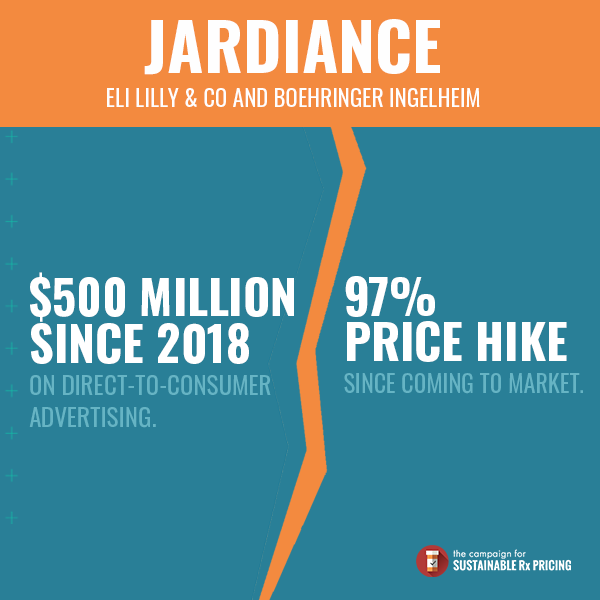

Jardiance – Eli Lilly & Co. and Boehringer Ingelheim

Jardiance – a top earner for Eli Lilly & Co. and Boehringer Ingelheim – has also experienced annual price hikes on its way to becoming a blockbuster. Since its first year on the market in 2015, Jardiance’s price has risen every year by at least four percent and has increased 97 percent in total during its time on the market. Last year, the drug brought in $2.06 billion in revenue for Eli Lilly & Co.

Another defining characteristic of Jardiance throughout its lifetime is DTC spending – reaching almost $500 million since 2018. In 2022, $158.6 million was spent advertising Jardiance on television. In 2021, at least $127 million was spent promoting the drug. And in 2019 and 2018, at least $100 million was spent advertising Jardiance each year.

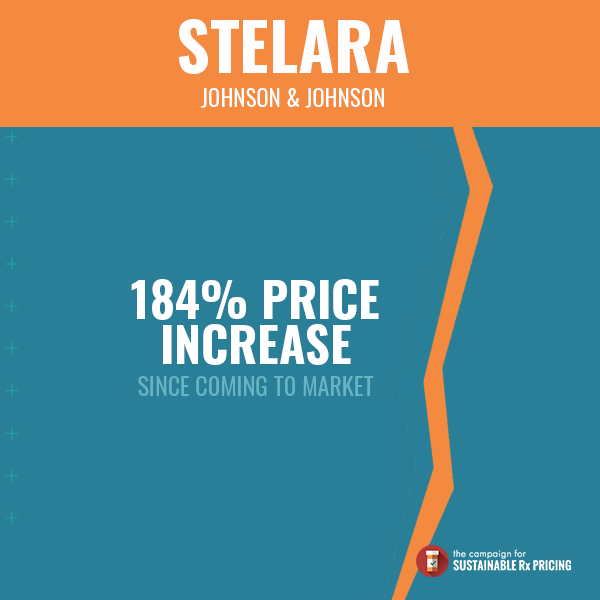

Stelara – Johnson & Johnson

Johnson & Johnson has increased the price of their top-selling psoriasis drug Stelara by at least 4.8 percent each year since 2012, and the drug’s price has risen 184 percent in total during its time on the market. In turn, the blockbuster made Johnson & Johnson $9.72 billion in sales last year.

Xarelto – Johnson & Johnson

Johnson & Johnson’s Xarelto has risen in price 168 percent since it came to market, and Johnson & Johnson has hiked the price by at least 4.8 percent each year since 2012. Last year, the drug brought in $2.47 billion in sales for the company. From 2013 to 2019, Johnson & Johnson spent upwards of $700 million advertising the drug, including $122 million in 2019, $141 million in 2018, $120 million in 2017, $113 million in 2015, $119 million in 2014 and $92.5 million in 2013.

Read more about Big Pharma’s DTC ad spending in 2022 HERE.

Learn more about Big Pharma’s biannual price increases HERE.

Read more on bipartisan, market-based solutions to hold Big Pharma accountable HERE.